TAXES. Ugh.

If you’d like some tips for making tax time easier next year, read on.

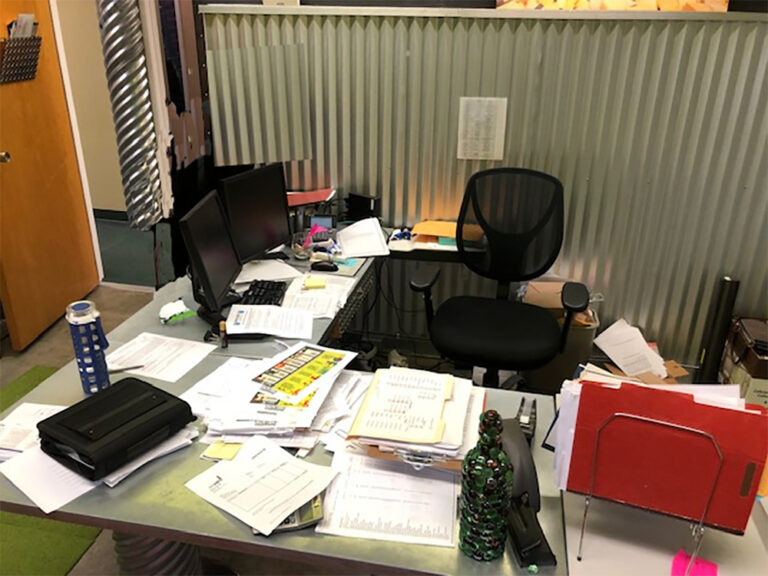

Did you get your taxes in on time or did you have to file for an extension? Were you stressed out trying to find the documents you need like W-2’s or receipts? I have several friends who had to scramble to find their tax docs, consuming time that could have been more productive. They could have been making money working for clients instead of searching piles or clogged files for what they needed.

Some people dread tax time because that is how their life looks every April. But others are calm and assured, with very little disturbing their daily routine. Why?

Organization. The people who don’t dread tax time are those who have their tax documents gathered in one place and have them filed early (especially if they are getting money back). Whether a business owner or a homeowner, doing a few key things will make it easier for you and your accountant when tax time rolls around.

My husband, Frank, and I each run our own business. Our client files are quite different, but our tax documents go into just a few files.

All receipts for tax deductible donations get put into an “Odd year tax” or “Even year tax” file, which we give to our accountant. We keep the rest of our records on Quickbooks, which we can email to our accountant.

Now, I don’t like updating my QB (I update it once a month), but Frank is excellent at updating it every time he receives a check. As his office manager, I take care of depositing and filing the check with the payment slip. That way, everything is in its place and recorded accurately, which makes tax time easier, and tracking our P&L easier as well.

Record keeping for taxes doesn’t have to be complicated. In fact, the simpler the better. It’s important to record what you take in and what you spend, and have a regular time of the week or month to update everything. It will be easier to remember if you schedule time on the same date each month like the 1st or the 15th.

For homeowners, just keeping a file that holds all the tax documents you get in the mail from your employer, your bank, your investments, etc, is the main thing you need to do. If you don’t have a file or a filing cabinet, a drawer or a basket will do, as long as you make a habit of sorting your tax documents into that place. As I mentioned earlier, have a place set up to drop receipts from charities or thrift stores so you can get all the deductions you are eligible for. They can all go into the same file, basket or drawer if you like.

And don’t forget mileage! Whether you use your vehicle for church, nonprofit or your business, tracking that mileage can really add up on your tax deductions. The government currently pays 56.5 cents per mile for business, 14 cents per mile for charitable service organizations. Did you know you can get reimbursed for medical visits and moving? You can.

I encourage you to put these or similar systems in place now, this week. Do it while you still remember the stress of gathering your tax documents this year. Instead of being stressed out in April, you will have peace of mind. And that’s a good way to be.